Why Building Credit Matters in Today’s World

If you’ve ever been denied a loan, car lease, or apartment rental, you’ve already felt the weight of having no credit history. In both the United States and the United Kingdom, your credit score acts as your financial résumé –it tells lenders, landlords, and even employars how trustworthy you are with money.

Building credit from scratch may seem intimidating & hectic, but the truth is, it’s totally possible to do. Think of it like building muscle—you just need time, consistency, confidence and the right techniques.

As American financial guru Suze Orman once said, “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” That’s exactly what good credit offers: freedom and peace of mind.

Understanding the Credit System

What Is a Credit Score?

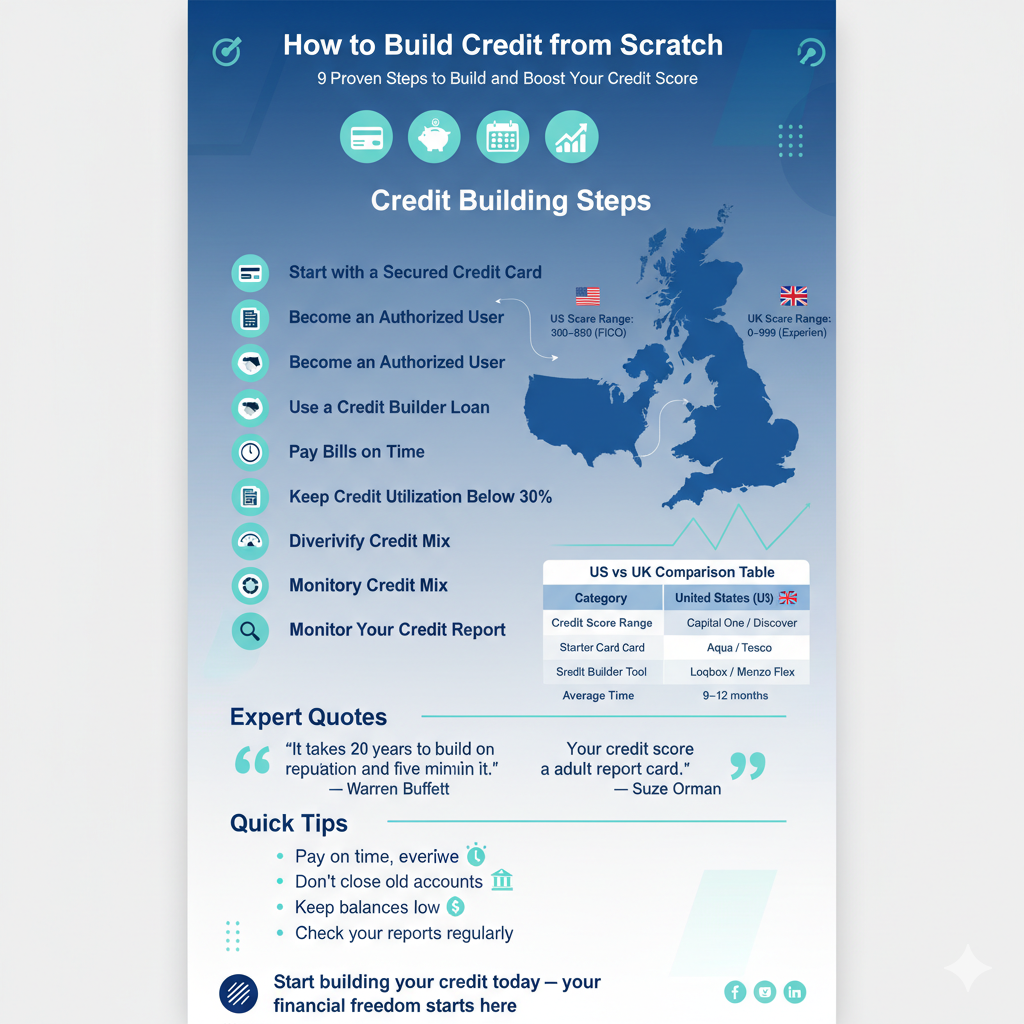

A credit score is a number that represents your creditworthiness. In the U.S., it’s typically a three-digit number ranging from 300 to 850, based on models like FICO and VantageScore. In the U.K., the scale varies by credit agency— Experian goes up to 999, while Equifax maxes out at 700.

Your score is determined by five key factors:

- Payment history.

- Credit utilization

- Length of credit history

- New credit inquiries

- Credit mix

US vs UK Credit Scoring Models

While both systems track financial behavior, their structures differ.

In the U.S., FICO scores are standard across lenders. In the U.K., each agency interprets data differently, meaning your “good” score with Experian might not be identical with Equifax.

| Category | United States (US) | United Kingdom (UK) | suggestion |

|---|---|---|---|

| Credit Score Range | 300 – 850 (FICO / VantageScore) | 0 – 999 (Experian) / 0 – 700 (Equifax) | Higher = Better Credit |

| Main Credit Bureaus | Experian, Equifax, TransUnion | Experian, Equifax, TransUnion | Same agencies operate in both regions |

| Common Starter Option | Secured Credit Card (e.g., Capital One, Discover) | Foundation Credit Card (e.g., Aqua, Tesco) | Use for small purchases, pay monthly |

| Alternative Builder Tools | Self, Chime Credit Builder | Loqbox, Monzo Flex | Regular payments boost score |

| Credit Utilization Target | Below 30% | Below 25% | Lower utilization = stronger credit health |

| Report Checking Tools | AnnualCreditReport.com, Credit Karma | Clearscore, Experian Free, TotallyMoney | Check monthly for errors |

| Average Time to Build Good Credit | 6–12 months | 9–12 months | Consistency is key |

| Key Legal Protections | Fair Credit Reporting Act (FCRA) | Consumer Credit Act | Learn your rights in each region |

| Common Mistake | Too many new applications | Ignoring old accounts | Keep accounts active and aged |

“Step 1 : Start with a Secured Credit Card.”

If you’re new to credit, a secured credit card is the best place to start. You’ll deposit a certain amount—say, $200—and that becomes your credit limit. Use it for small purchases, pay it off monthly, and watch your credit score grow.

Choosing the Right Secured Card

Look for cards that:

- Report to all major credit bureaus

- Have low fees

- Offer an upgrade path to an unsecured card after consistent payments

Popular U.S. options: Discover it® Secured, Capital One Platinum Secured.

In the U.K.: Aqua Classic Card, Tesco Foundation Credit Card.

Step 2: Become an Authorized User

Ask a family member or close friend with excellent credit to add you as an authorized user on their credit card. Their good payment history can positively influence your report—just ensure they practice responsible habits.

This strategy helped many young Americans, including financial personality Dave Ramsey, who advises: “Credit is a tool, not a goal. Use it wisely, and it can open doors, not debts.”

Step 3: Use a Credit Builder Loan

Many banks and fintech companies like Self (U.S.) and Loqbox (U.K.) offer credit builder loans. You make fixed monthly payments, and once the loan is complete, you get the money back—plus a better credit score.

Step 4: Pay All Bills on Time, Every Time

Payment history is the single most important factor in your credit score—accounting for 35% of it. Even one missed payment can drop your score significantly.

The Power of Payment History

Automate your bills, set reminders, and never miss due dates. In the words of Warren Buffett, “It takes 20 years to build a reputation and five minutes to ruin it.” Your credit reputation works the same way.

Step 5: Keep Credit Utilization Low

Aim to use less than 30% of your total credit limit. High utilization suggests risk, even if you always pay on time.

Example: If your limit is $1,000, try to keep your balance under $300.

Step 6: Diversify Your Credit Mix

Once you’ve mastered credit cards, consider adding an installment loan (like a small personal or auto loan). A healthy mix of credit types shows lenders you can manage different accounts responsibly.

Step 7: Monitor Your Credit Report Regularly

Regularly checking your credit helps catch identity theft or reporting errors early.

Free Tools to Check Your Credit Score

- U.S.: AnnualCreditReport.com, Credit Karma, Experian Free

- U.K.: Clearscore, Experian Free, TotallyMoney

If you find errors, dispute them directly with the bureau. Accuracy is everything.

Common Mistakes to Avoid When Building Credit

- Applying for too many credit cards at once

- Closing old accounts (which shortens your credit history)

- Ignoring small debts

- Not reviewing your credit reports

How Long It Takes to Build Good Credit

Patience is key. You can usually establish a decent score (around 650–700) within 6–12 months of responsible use. Excellent credit (750+) often takes 2–3 years of consistent management.

Expert Insights from Financial Icons

- Suze Orman emphasizes that “Your credit score is your adult report card.”

- Dave Ramsey warns that “credit cards aren’t bad, but debt is dangerous.”

- Mark Cuban often says the best investment you can make is in financial literacy itself.

- Warren Buffett reinforces the timeless truth: reputation (and credit) is earned slowly and lost quickly.

FAQs About Building Credit from Scratch

1. How can I build credit with no credit history?

Start with a secured credit card, a credit builder loan, or become an authorized user.

2. How long does it take to get a credit score?

Typically, 3–6 months of reported activity.

3. Does rent payment affect my credit?

Yes—if reported through services like Experian Boost or CreditLadder.

4. Should I close my first credit card?

No. Keeping it open helps maintain your credit history length.

5. Can student loans help build credit?

Yes, if you make on-time payments consistently.

6. What’s a good credit score?

U.S.: 700+ is good, 750+ is excellent.

U.K.: 800+ with Experian is strong.

Take Charge of Your Financial Story

Building credit from scratch isn’t about luck—it’s about discipline, patience, and smart choices. Whether you’re in New York or London, the journey begins the same way: one responsible decision at a time.

In the words of Benjamin Franklin, “An investment in knowledge pays the best interest.” Learning how to build credit is one of the smartest investments you’ll ever make.

External Resource:

For official credit-building resources, visit the Consumer Financial Protection Bureau (CFPB).