Living on a low income doesn’t mean giving up on financial security

Smart Ways to Budget with a Low Income

Why Smart Budgeting Matters More Than Ever

Living on a small paycheck isn’t easy — whether you’re a college student balancing tuition costs, a part-timer managing bills, or simply someone on a tight budget. That’s why these easy budgeting hacks for students and part-timers or any low budget person are absolute game-changers. With a few smart money moves, you can stretch your income, save consistently, and still enjoy life without financial stress. Budgeting isn’t about giving things up — it’s about gaining control, freedom, and peace of mind .

How to make a realistic budget when you earn less than $2,000 a month

1. Adjust Your Budget: The First Step Toward Financial Control

The first thing I had to learn was flexibility. A budget isn’t a rigid rulebook — it’s a living guide.

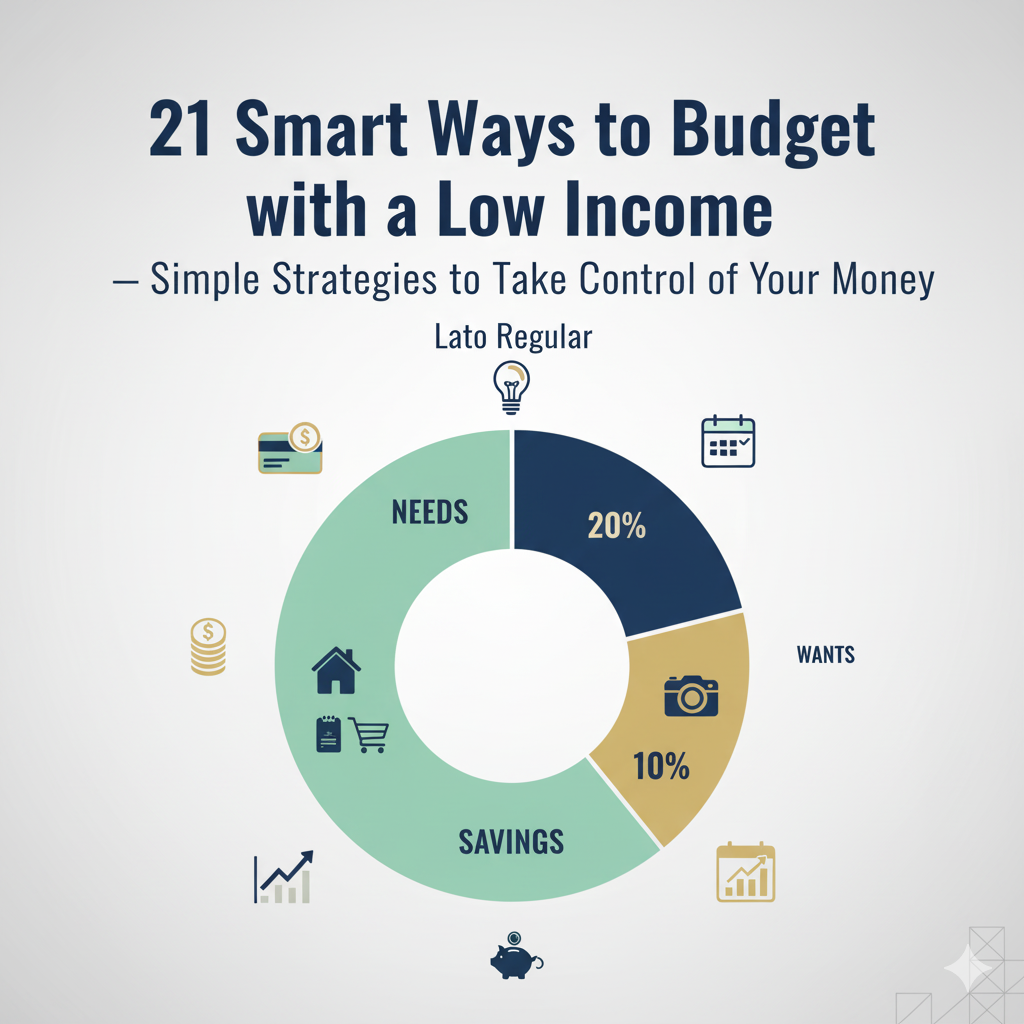

Start by using the 50/30/20 rule, but adapt it: maybe 70% needs, 20% savings, 10% wants when income is tight. Tools like Mint or YNAB (You Need A Budget) help adjust automatically as expenses shift.

💬 “A budget is telling your money where to go instead of wondering where it went.” — John C. Maxwell

2. Assess Your Income: Know Where Every Dollar Comes From

Before trimming the fat, understand what you’re working with. List every source — wages, benefits, side gigs, or even child support. Use a spreadsheet or apps like PocketGuard.

When I first listed my income streams, I found unused cashback credits and a forgotten freelance payment! Easy budgeting hacks for students and part-timers help too much for support

3. Track Your Expenses: Understanding the Flow of Money

Every latte, every gas refill — they add up. Track spending daily or weekly. I started using the “cash envelope method” — a classic that’s making a comeback on TikTok as #CashStuffing.

Tracking exposes habits that silently drain your money, making it easier to cut them off.

4. Cut Unnecessary Expenses: Keep Only What Truly Adds Value

Audit your spending. Do you really need multiple streaming subscriptions or that premium coffee every day? I found that even canceling one $15 subscription saved nearly $200 a year.

5. Cancel Unnecessary Subscriptions: The Silent Budget Killer

Subscription fatigue is real. Use Trim or Rocket Money to find recurring charges. These tools cancel unused services and even negotiate lower bills.

You’d be surprised how many people still pay for old gym memberships or apps they never open.

What are the smartest ways to save money on groceries in the U.S.?

6. Lower Housing Costs: Think Smaller, Smarter, and Sharper

Housing eats the biggest portion of income in the U.S., U.K., and Canada.

Consider roommates, downsizing, or negotiating rent. Some landlords may reduce rent for early payments or maintenance help.

Alternatively, explore Section 8 housing (U.S.) or Housing Benefit (U.K.) programs.

7. Reduce Energy Usage: Save the Planet, Save Your Wallet

Simple energy tweaks can reduce utility bills by 10–20%.

- Switch to LED bulbs

- Unplug unused electronics

- Apply for energy rebates like Canada’s “Greener Homes Grant”

🌍 “Energy efficiency isn’t just smart — it’s survival.” — Elon Musk

7 High-Demand IT Jobs in 2026 — Your Guide to Trends, Skills & Opportunity

8. Budget for Food: Eat Healthy, Spend Wisely

Meal prepping saves both money and sanity. I cut my grocery bill by 30% using apps like Flipp and Ibotta.

Buy in bulk, use discount stores like Aldi or Lidl, and try community-supported agriculture (CSA) boxes.

9. Shop Intelligently: Maximize Value Every Time You Spend

Use browser extensions like Honey or Rakuten to find automatic coupons.

Black Friday? Only buy essentials.

Amazon? Check price history using CamelCamelCamel before clicking “Buy Now.”

10. Find Ways to Cut Costs: Get Creative With Frugality

Embrace DIY. Learn basic home repairs on YouTube. Swap clothes on Vinted or ThredUp.

Every small saving compounds over time — that’s the “snowball effect” of smart money habits.

11. Automate Your Regular Bill Payments: Never Miss a Due Date

Late fees are silent killers. Automating payments ensures consistency.

I set mine to withdraw two days after payday — it eliminates mental clutter. Easy budgeting hacks for students and part-timers always supportive

How to increase income without a second job

12. Automating Your Savings: Pay Yourself First

The best hack? Make saving automatic.

Set up auto-transfers from checking to savings right after payday.

Apps like Acorns round up purchases and invest the difference.

💬 “Don’t save what’s left; save first, then spend the rest.” — Warren Buffett

13. Build an Emergency Fund: The Foundation of Stability

Aim for $500 first, then three months’ expenses.

Use high-yield savings accounts like Ally Bank or Wealthsimple (Canada).

Even $10 a week matters — it’s not about how much you start with, but that you start.

14. Eliminate Your Debt: Free Yourself From Financial Chains

Use the debt snowball method (start small) or debt avalanche (target high-interest first).

Contact creditors to negotiate lower interest or payment extensions.

Resources: National Debtline (UK), NFCC (USA).

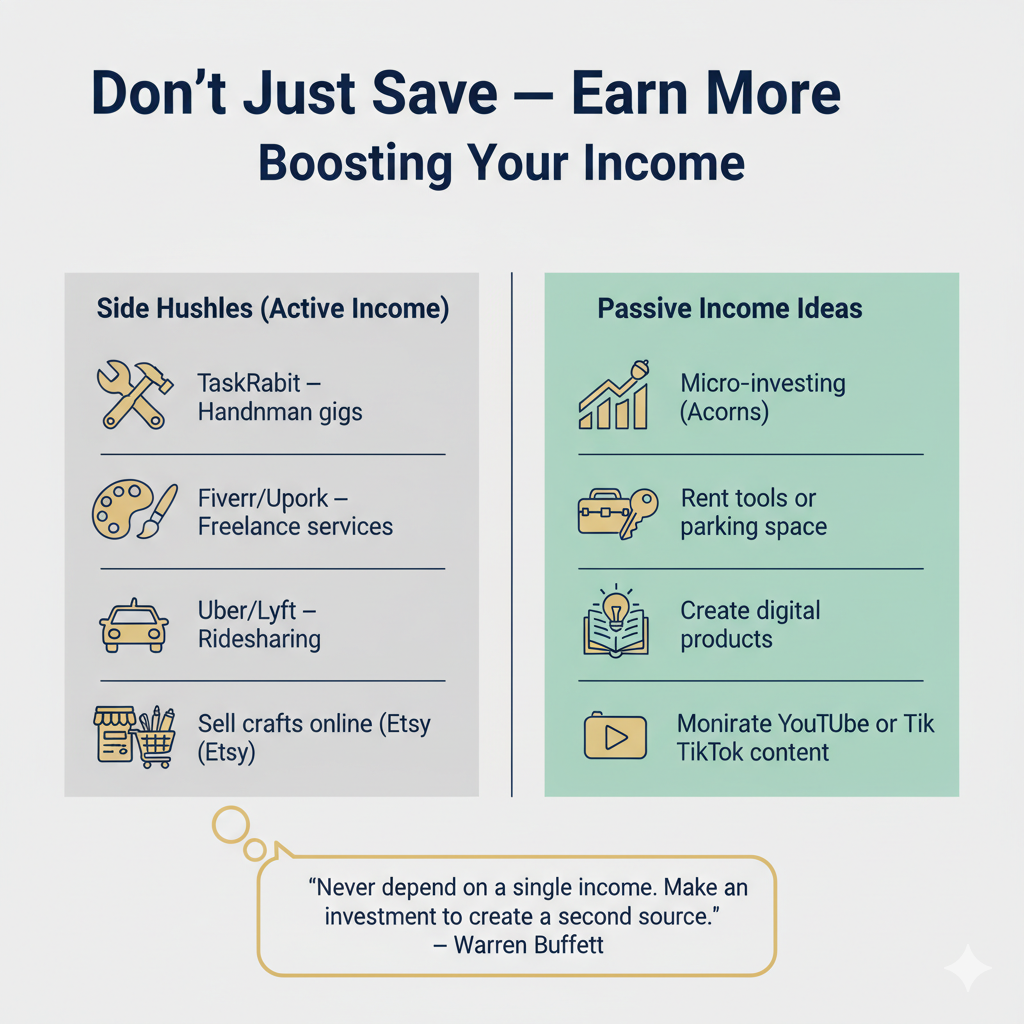

15. Increase Income: Think Side Hustles and Passive Streams

Side gigs aren’t just trends — they’re modern survival tools.

Freelancing, Uber driving, selling crafts, or teaching online can bridge income gaps.

Platforms like Fiverr, TaskRabbit, or Upwork make it easier than ever.

Simple ways to budget for single parents

16. Extra Income Opportunities: Turn Skills Into Cash

Leverage AI-powered jobs (e.g., content editing, prompt writing, transcription).

Or rent out unused tools or parking spaces.

Every extra $50–$100 per month adds resilience.

How to Build Credit from Scratch (US/UK-Specific): 9 Smart Steps to Jumpstart Your Credit Journey

17. Sell Unused Items: Turn Clutter Into Capital

Decluttering pays. I sold unused gadgets on Facebook Marketplace and clothes on Poshmark.

That $300 windfall went straight into my emergency fund.

18. Check Your Entitlements: Don’t Miss Free Financial Support

Many don’t realize they qualify for assistance.

- USA: SNAP, Medicaid, LIHEAP

- UK: Universal Credit, Council Tax Reduction

- Canada: GST/HST credits, Child Benefits

Always check your eligibility — it’s your right.

How to build financial security on minimum wage

19. Look for Support: Seek Community and Government Programs

Community banks, nonprofits, and food banks often offer financial counseling or emergency aid. Local libraries even host free “financial literacy” workshops. Easy budgeting hacks for students and part-timers is always supportive

💬 “Alone we can do so little; together we can do so much.” — Helen Keller

20. Cultivate Good Spending Habits: Build Wealth Mindfully

Use a “24-hour rule” before non-essential purchases.

Track emotional spending triggers.

As financial coach Dave Ramsey says, “You must gain control over your money or the lack of it will forever control you.”

21. Make Saving Routine: Build Long-Term Financial Freedom

The goal isn’t to live cheap; it’s to live free.

Saving becomes easier when it’s habitual — like brushing your teeth.

Celebrate milestones. Reward consistency. That’s what builds wealth sustainably.

How to make saving a daily habit

Related Information Table: Tools & Resources

| Category | Recommended Tools/Resources | Country |

|---|---|---|

| Budgeting | Mint, YNAB, PocketGuard | USA, Canada, UK |

| Savings | Ally Bank, Wealthsimple, Chime | USA, Canada |

| Coupons & Cashback | Rakuten, Honey, Ibotta | USA, UK |

| Energy Savings | Energy Star, Greener Homes Grant | USA, Canada |

| Debt Support | NFCC, National Debtline | USA, UK |

FAQs About Budgeting With a Low Income

1. What’s the best first step in budgeting with a low income?

Start by tracking every expense for 30 days — awareness creates control.

2. How much should I save monthly if I earn very little?

Even $10–$20 a week counts. The key is consistency, not the amount.

3. Should I pay off debt or build savings first?

Build a $500 emergency fund first, then tackle high-interest debt.

4. Are budgeting apps safe to use?

Yes, most are encrypted and bank-certified. Stick with reputable ones like YNAB or Mint.

5. How can I make saving less boring?

Gamify it — use visual trackers, join #NoSpendChallenge on TikTok, or set milestone rewards.

6. What are some free budgeting resources?

Check Consumer.gov Budgeting for U.S. tools or MoneyHelper UK.

Your Journey to Financial Empowerment Starts Now

Budgeting with a low income isn’t about restriction — it’s about reclaiming freedom. Every step you take, from canceling a subscription to automating savings, builds momentum.

Financial freedom doesn’t happen overnight, but with intention and discipline, it’s absolutely achievable. Remember: “It’s not your salary that makes you rich, it’s your spending habits.” — Charles A. Jaffe.

never forget for Easy budgeting hacks for students and part-timers

Tags: #SmartBudgeting #LowIncomeLiving #PersonalFinance #BudgetTips #FinancialFreedom #MoneyManagement #USA #UK #Canada